Exploring Big Ideas In Consumer Investing

Plus 7 Lessons in Business Strategy from the World's Richest Man

Greetings dear readers, and hope you’re all having a wonderful summer so far!

The last few editions have been focused on health & wellness, so today we’ll be shifting our focus somewhat back to investing, in partnership with an institutional investment management firm. Aside from all the hype about big tech and AI, the central pillar of the global economy that is the global consumer is often overlooked.

“But Jean, why is the consumer so important?”

Well for starters, consumer spending accounts for a significant portion of the United States' gross domestic product (GDP). In recent years, consumer spending has typically represented around 68% to 70% of the U.S. GDP.

And when that GDP is $23trillion, then it is worth paying attention to that metric and said consumer!

That said, consumer investing is a dynamic field that requires a deep understanding of evolving trends and changing consumer behaviors. I like to spend time thinking about the American consumer as a representation for global consumer investment ideas, and nowhere do I get as good a grasp of this as when I spend time across the coasts of the United States.

Late June / early July, I returned from a long trip to New York City where I met with friends, clients, prospects and thought leaders in investment management. One of my meetings was with Infusive Asset Management, who are a dynamic investment team focusing on global consumer goods and investing across sectors in the businesses, they believe, will capitalize on the best demographic and technological trends.

Two important disclaimers:

This is NOT investment advice! Past performance is not indicative of future returns;

I have Infusive Asset Management’s permission to share some of these materials to this broader audience. If you wish to receive the full presentation please do get in touch with me directly or contact Infusive: ir@infusive.com.

About Infusive and the Materials Used in this Newsletter:

Infusive, a global investment firm focused exclusively on the consumer sector, presented their "Big Ideas" deck to me recently, which takes us on a journey to 2030, shedding light on the factors and drivers that will shape consumer behavior and activity. Backed by extensive research from their experienced investment team, Infusive's Big Ideas encapsulate the essence of consumer desire and offer insights into the potential investment opportunities of the future.

Infusive's Investment philosophy centers around identifying businesses with "Consumer Alpha." These are companies that possess attributes such as cherished products and brands, pricing power, expansive reach, and unwavering multigenerational customer loyalty. By investing in brands that hold unwavering sway and leveraging compelling demographic trends and attractive industry tailwinds, Infusive aims to capture superior long-term compounding potential.

Visualizing Select Consumer Trends

Here are some of my favorite charts from the Big Ideas presentation.

Channels Change, Chanel Doesn't:

While distribution channels may evolve over time, beloved brands endure. The Big Ideas presentation highlights the timeless appeal of established brands that remain consistent amidst changing platforms. This underscores the importance of investing in companies with enduring customer loyalty and brand recognition.

Premiumization: from Good to Great

The Big Ideas presentation highlights the growing trend of premiumization in consumer goods. Consumers are increasingly willing to pay a premium for products and experiences that align with their desires and aspirations.

For instance, the presentation notes that the sophistication of palates is driving the sales of premium chocolates, while premium alcohol is expected to gain a larger market share across various categories.

See respective charts on chocolate and alcohol.

Having Less Kids, More Pets:

As demographic shifts occur globally (see New York Times article here), with lower fertility rates in developed countries and aging populations, the Big Ideas presentation sheds light on an interesting trend: the rising importance of pets.

While the birth rate declines, the global pet market is expected to grow by 50% by 2030. Consumers are treating their pets like family members and seeking high-quality, healthy products for them. This trend presents opportunities in the pet healthcare and insurance sectors, particularly in markets with low pet ownership penetration, such as Asia.

63% of Millennials, 57% of Gen-X and 45% of Boomers say they treat their pet like a child!

Here’s a chart of pet spending projections across the United States.

Beauty: for Confidence and Identity

The beauty industry has proven to be resilient through economic cycles as consumers continue to seek ways to express their identity and boost confidence. Estée Lauder, for example, has successfully tapped into a younger consumer base. The Big Ideas presentation recognizes the enduring demand for beauty products and the potential for continued growth in this sector.

Coffee and Snacks: Recession-Resilient Indulgences

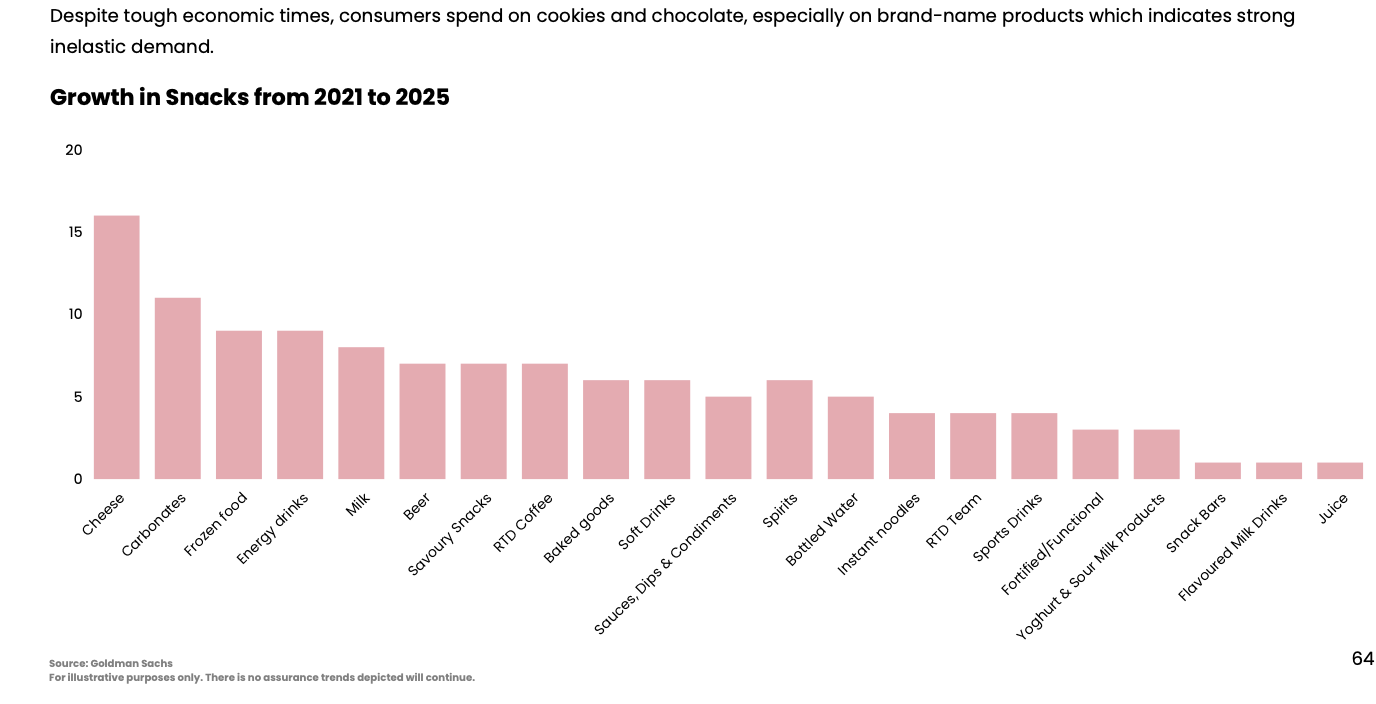

Even in tough economic times, certain consumer indulgences remain strong. The presentation highlights the inelastic demand for coffee and reveals that Asia is catching up in terms of coffee consumption. Moreover, consumers continue to spend on brand-name snacks like cookies and chocolate, indicating strong and consistent demand.

Bonus Section: 7 Lessons in Consumer Business Strategy from the World's Richest Man

In this section, and speaking of consumer investing with Infusive, we look to the king of consumer luxury goods for strategy and tactics on the space: Bernard Arnault.

In the unlikely event that you’ve been living under a rock, he is the richest person in the world (depending on which day you check), and LVMH’s CEO & Chair since 1989. LVMH has a portfolio of 75 luxury brands, so the guy knows a thing or two about consumer businesses… see below for a sample:

Lesson #1 - Control the Distribution - LV & Dior sell exclusively in their stores in 63 countries."If you control your distribution, you control your image" - Bernard Arnault

Lesson #2 - Emphasize Emotion. Sought-after products forge lasting consumer ties. "The most important word in our business is desire" - Bernard Arnault

Lesson #3 - Execute Ruthlessly. Earned the nickname "Terminator" after sacking 9,000 people at Dior in 1987. "I am very competitive, I always want to win" - Bernard Arnault

Lesson #4 - Expand Globally. LVMH's Asian revenues have increased 10x in 10 years. "China's population and buying power is increasing by the day" - Bernard Arnault

Lesson #5 - Create Exceptional Products. Focus is on high quality & premiumization. "We don't do marketing; we just create products which are exceptional in their design & craftsmanship" - Bernard Arnault

Lesson #6 - Resilience and Aggression. Always be seeking opportunties, while others are fearful. "Every time there is a crisis, we gain market share" - Bernard Arnault

Lesson #7 - Be Timeless. Iconic 1896 canvas by LV's son, remains cherished. "A good product can last forever" - Bernard Arnault

On the investment side, the numbers speak for themselves. Since forming in 1987, LVMH is the first European company with a valuation in excess of $500 billion.

As the markets and consumers would say: J’aDior…

Concluding Remarks:

The unstoppable demographic and technological trends outlined in Infusive's Big Ideas presentation offer valuable insights for consumer investing. By identifying market leaders armed with historical experience and insights, investors can position themselves to capitalize on future trends. And it’s not just in equity investing: the growth of secondary market trading in luxury goods continues to remain strong (e.g. luxury watches, apparel, handbags etc.).

Infusive's unwavering focus on consumer-centric investments presents an exciting opportunity to ride the wave of change and benefit from the long-term compounding potential of the consumer sector. As consumer behaviors continue to evolve, staying attuned to the Big Ideas shaping the industry will be paramount for successful investment strategies.

This is why strong brands capitalize on these trends and perform consistently over time.

On that note, until next time aka ‘A la prochaine’!

Jean